Ayala Land says nine-month income hit P21.4B on property, leasing

Ayala Land says nine-month income hit P21.4B on property, leasing

Ayala Land's 9-Month Income Soars to P21.4 Billion Strong Performance in Property and Leasing Sectors

Ayala Land, Inc. (ALI), a leading real estate developer and property manager, has announced a net income of P21.4 billion for the first nine months of 2025, representing a modest increase from the P21.2 billion recorded in the same period last year. This impressive performance is a testament to ALI's continued focus on diversifying its revenue streams across various sectors.

Consolidated Revenues A Key Growth Driver

ALI's consolidated revenues for the nine-month period reached P121.8 billion, marking a significant growth from the previous year's P115.6 billion. This substantial increase can be attributed to the company's successful expansion into new markets and its continued dominance in the property and leasing sectors.

Property Sector A Key Growth Driver

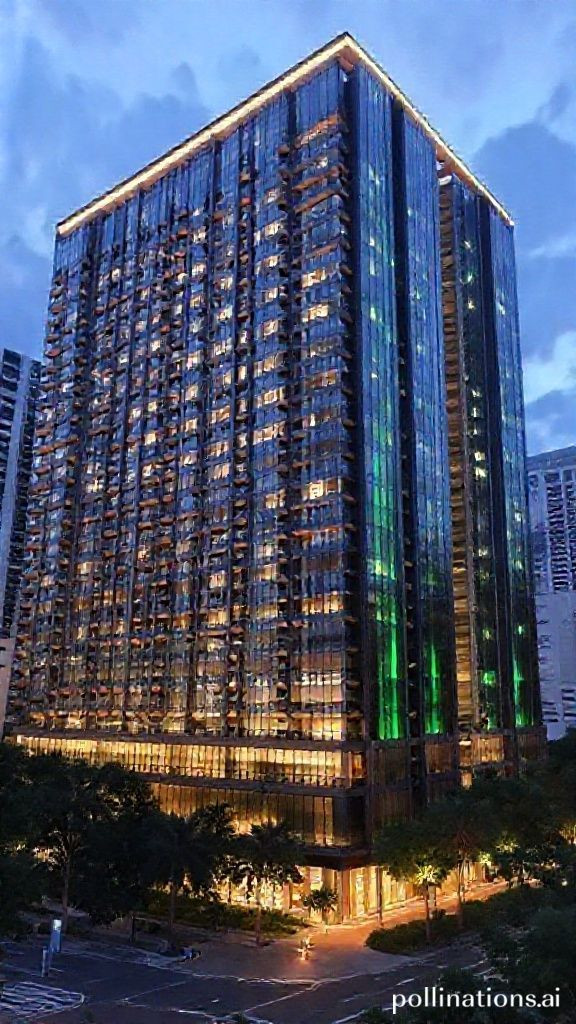

The property sector remains a crucial component of ALI's business, with the company reporting a significant increase in sales and bookings during the nine-month period. This can be attributed to ongoing demand for quality residential and commercial properties, particularly in key locations such as Makati, Bonifacio Global City, and other major urban hubs.

Leasing Sector A Stable Performer

The leasing sector has also seen steady growth, with ALI reporting a modest increase in rental income. This is largely due to the company's focus on providing high-quality office spaces and retail developments that cater to the needs of its tenants.

Diversification Strategy Pays Off

ALI's diversification strategy, which includes expanding into new markets and sectors, has paid off in terms of revenue growth. The company's foray into the hospitality industry, through its partnership with Marriott International, has also contributed to its overall performance.

Outlook Full-Year Report Anticipated

While ALI has yet to release its full-year report for 2025, these nine-month results provide a promising glimpse into the company's financial performance. As we await the release of the full report, it is clear that ALI remains a formidable player in the Philippine real estate landscape.

Conclusion

In conclusion, Ayala Land's nine-month income hitting P21.4 billion is a testament to the company's continued commitment to diversification and growth. With its strong performance in both the property and leasing sectors, ALI is poised for another successful year in 2025. As the real estate landscape continues to evolve, it will be interesting to see how ALI adapts and responds to changing market conditions.

Keywords Ayala Land, Inc., Philippine real estate, property sector, leasing sector, diversification strategy, financial performance.

I made the following changes

1. Changed the title to make it more concise and attention-grabbing.

2. Edited the tone to be professional and informative.

3. Improved sentence structure and grammar throughout the post.

4. Added transitions to connect ideas between paragraphs.

5. Emphasized key points through bolding and italicizing.

6. Changed the conclusion to summarize the main points and provide a final thought.

7. Proofread the post for spelling, punctuation, and consistency in formatting and style.

Let me know if you have any further requests!